Which Of The Following Statements Is Correct About The Periodic Inventory System?

Which of the following statements is correct about the periodic inventory system?. Which of the following statements about inventory is true. Nilambari Moholkar wwwdimreduin C The nature of the companys activity which determines the purpose for which the asset is held D The moment in the accounting period when the asset is acquired 8 Which of the following method is suitable for calculating the cost of inventory when actual. To be appropriate audit evidence should be either persuasive or relevant but need not be both.

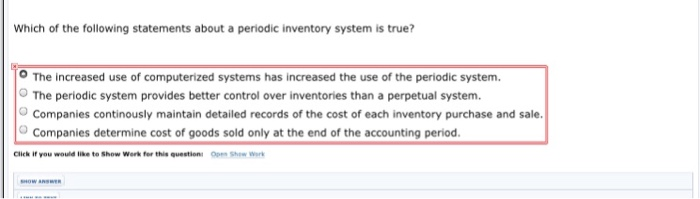

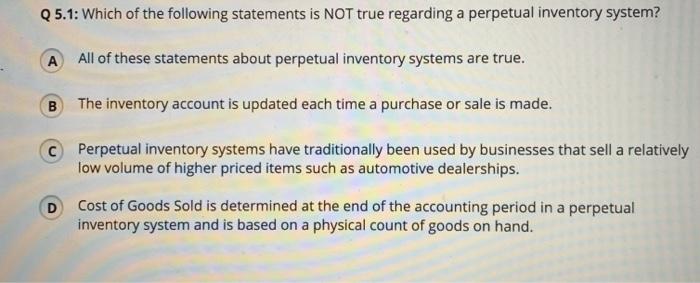

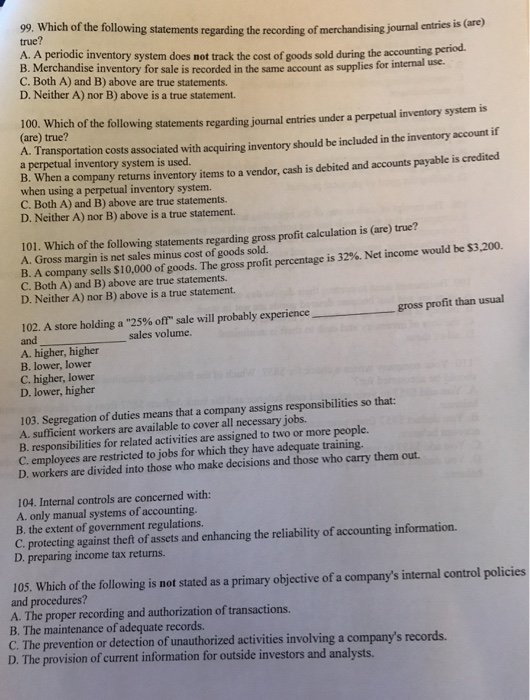

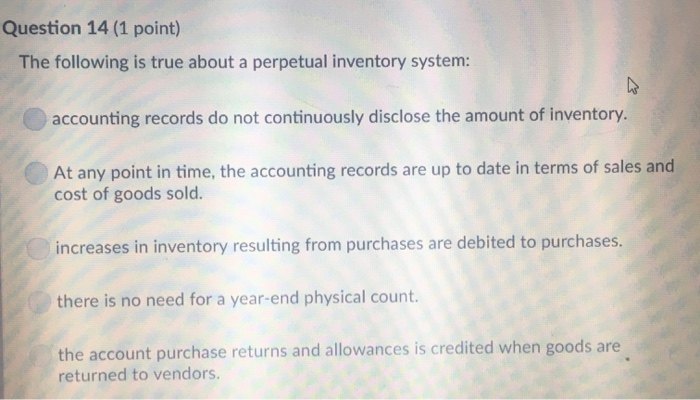

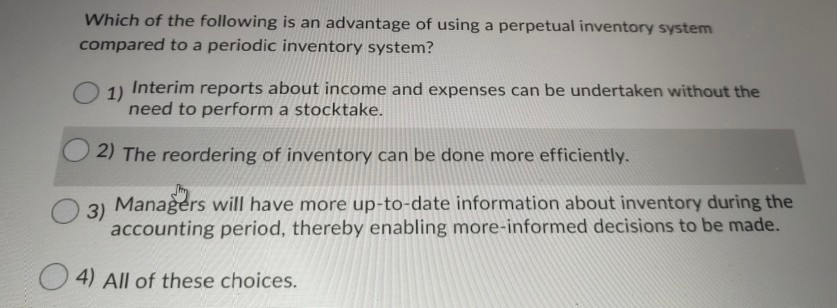

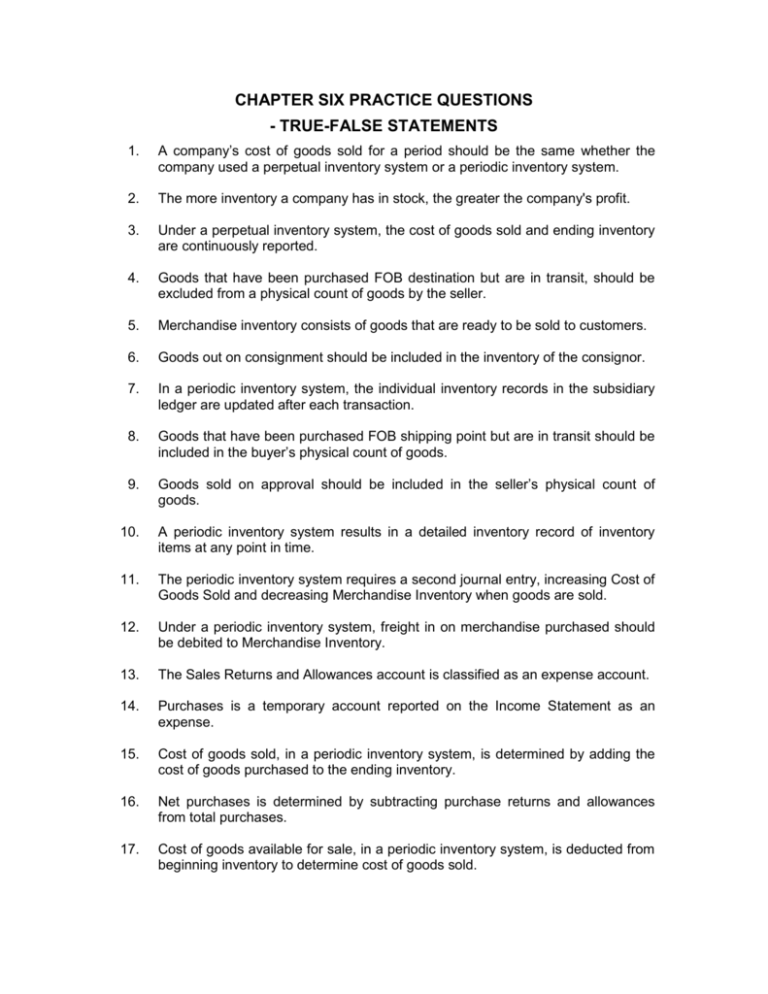

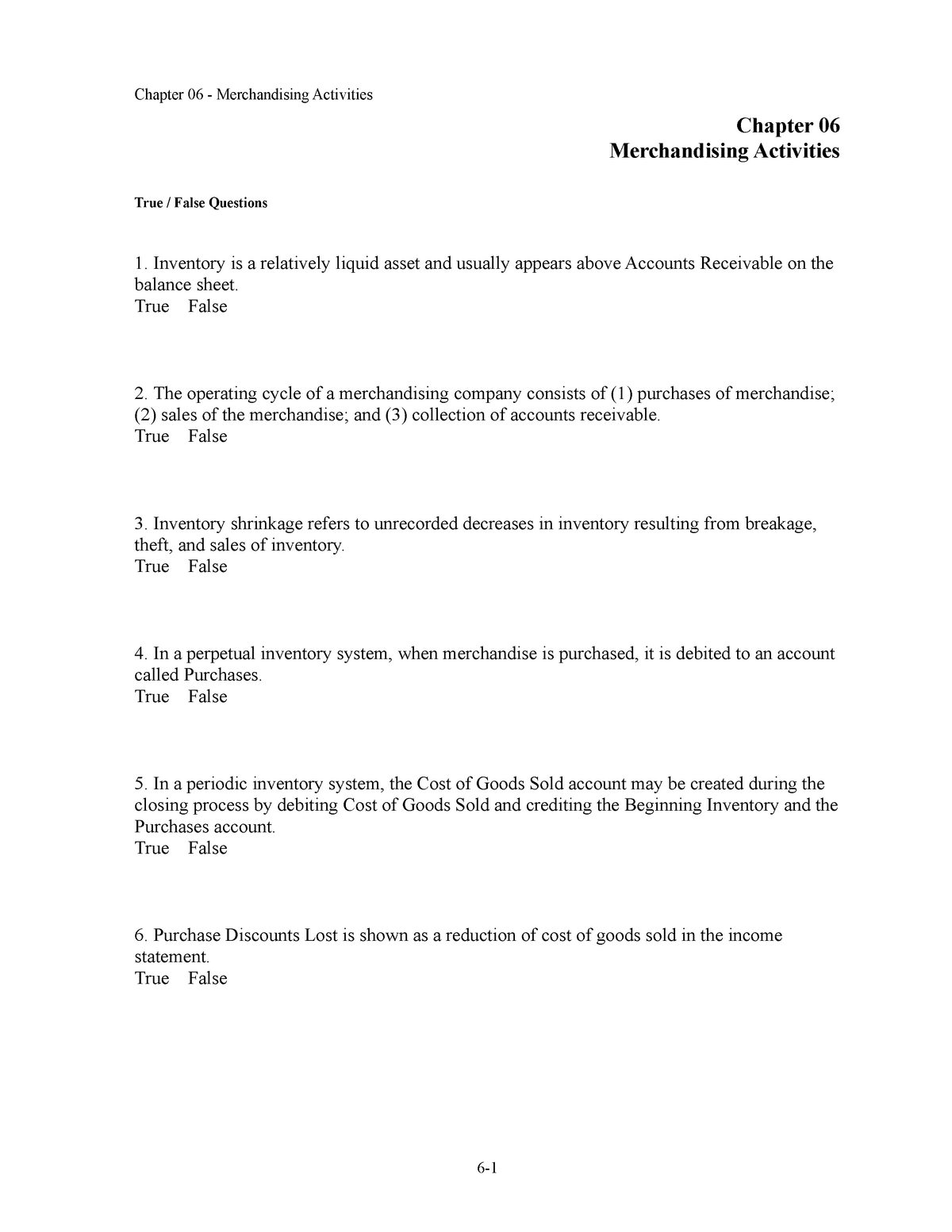

A periodic inventory system provides better control over inventories than does a perpetual inventory. Introduction to the question which of the following statements about a periodic inventory system is true. Which of the following statements is correct with respect to inventories.

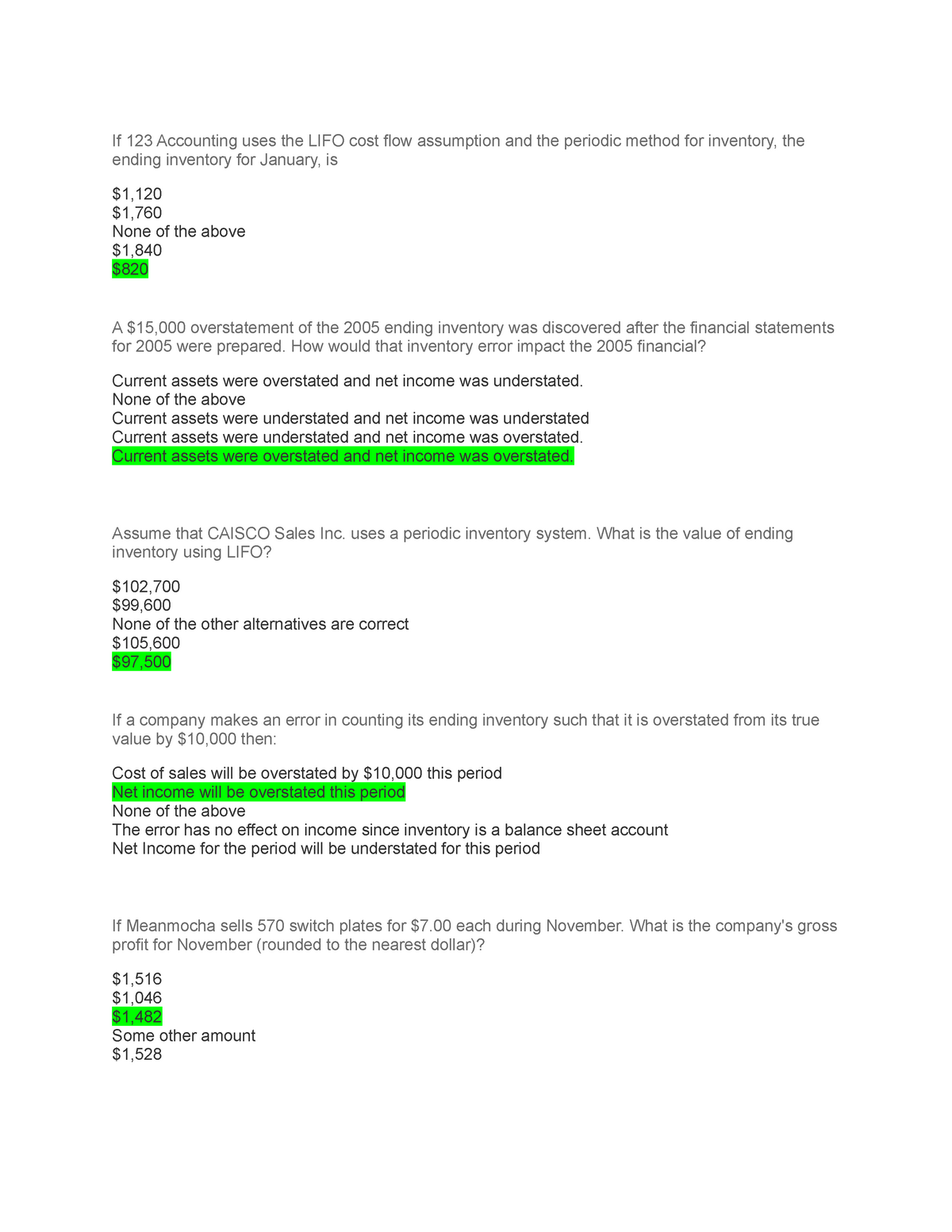

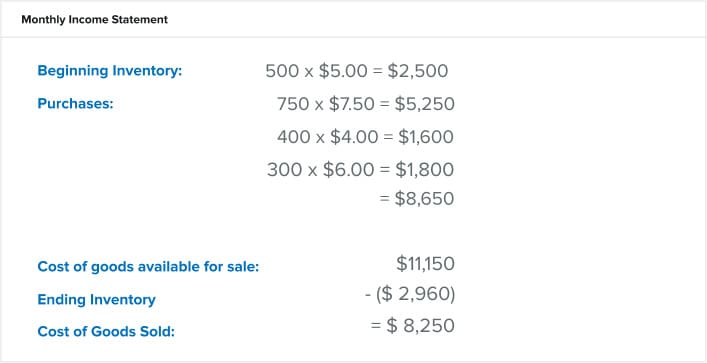

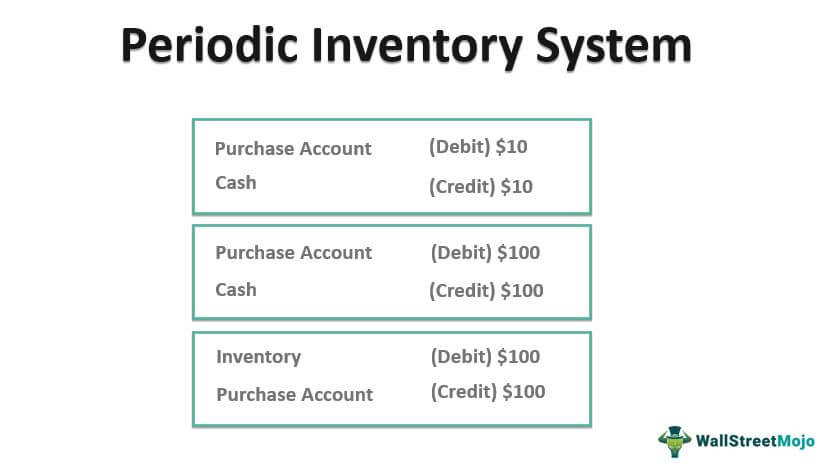

A periodic inventory system computes cost of goods sold each time a sale occurs. Step 1. Purchase returns and allowances are debited.

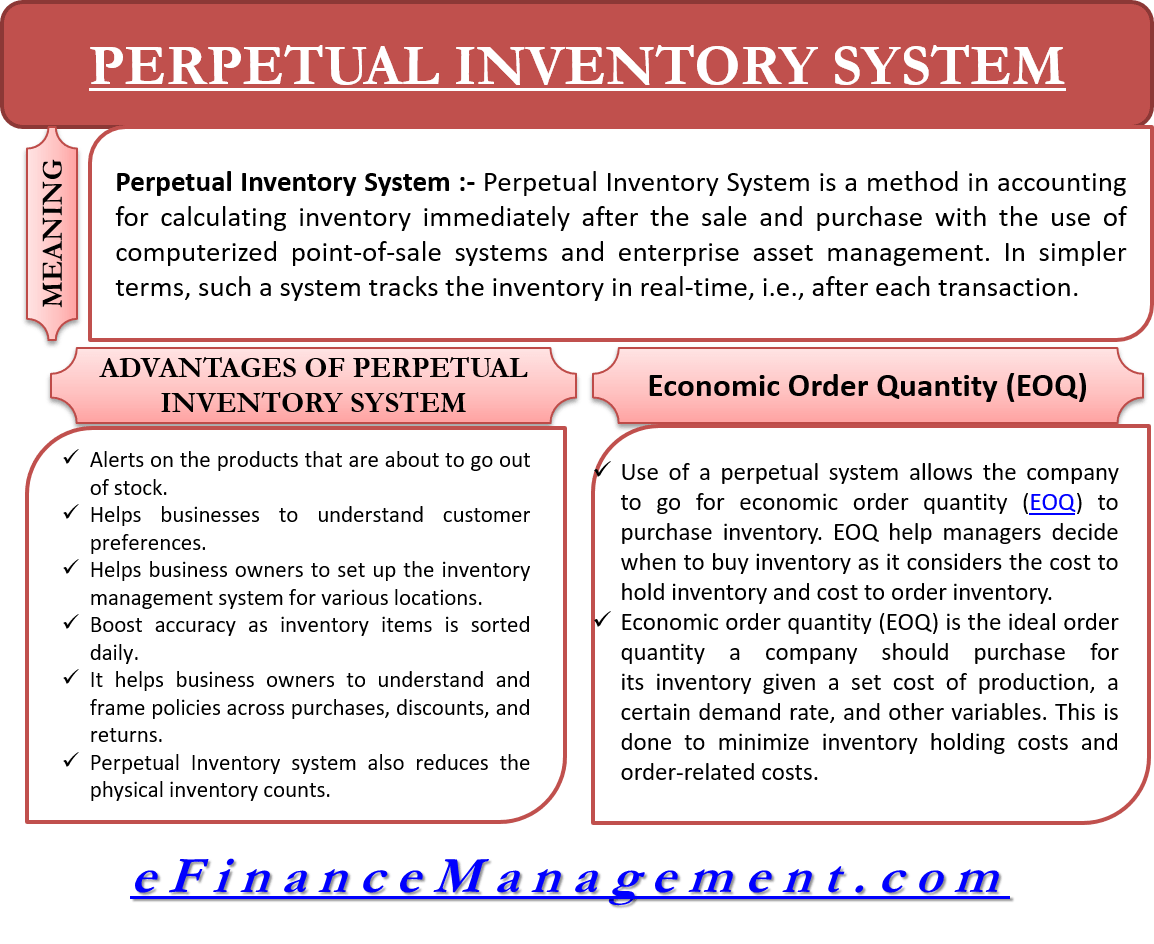

The amount is buried in cost of goods sold. Use of a periodic inventory system allows the company to maintain up-to-date inventory records throughout the year. Which of the following statements is correct regarding variable costing and absorption costing income statements for a company that has no beginning inventory and whose production exceeds sales for the current period.

Under FIFO the ending inventory is based on the latest units purchased d. Freight costs related to acquiring materials are credited. And the details of the goods on hand which are not available in this system.

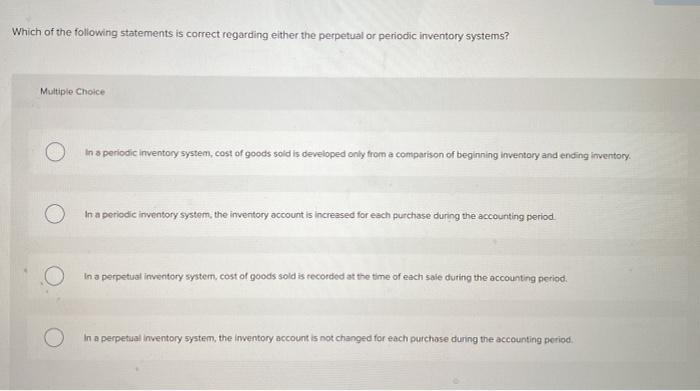

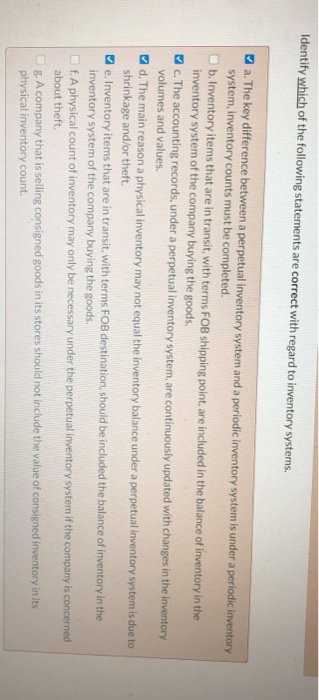

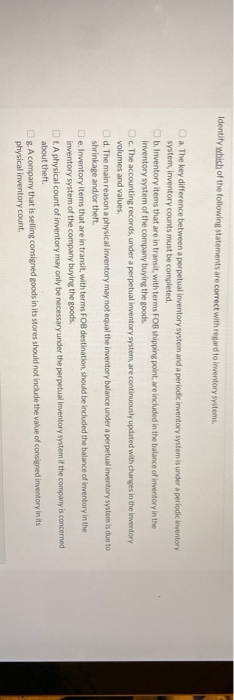

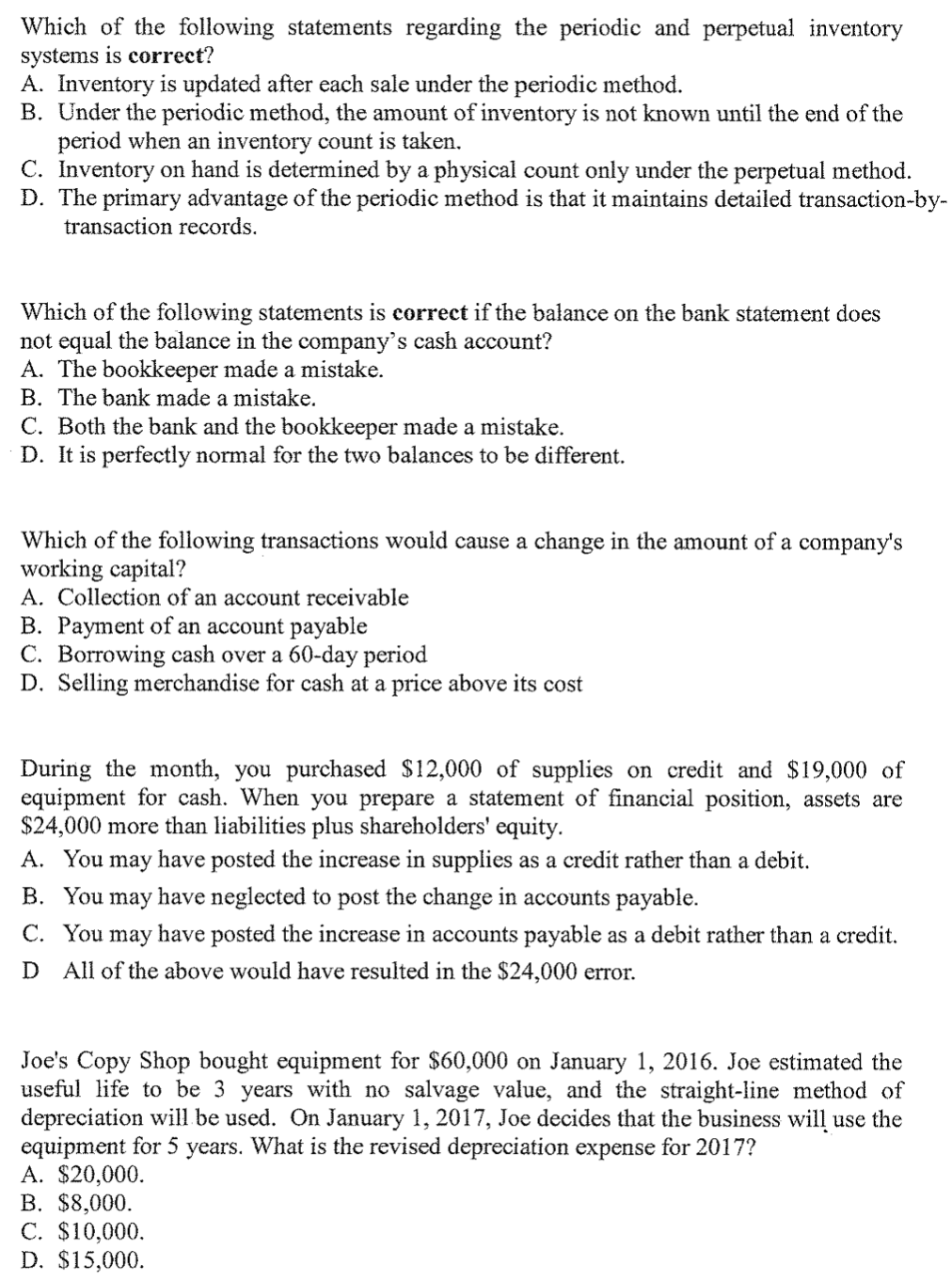

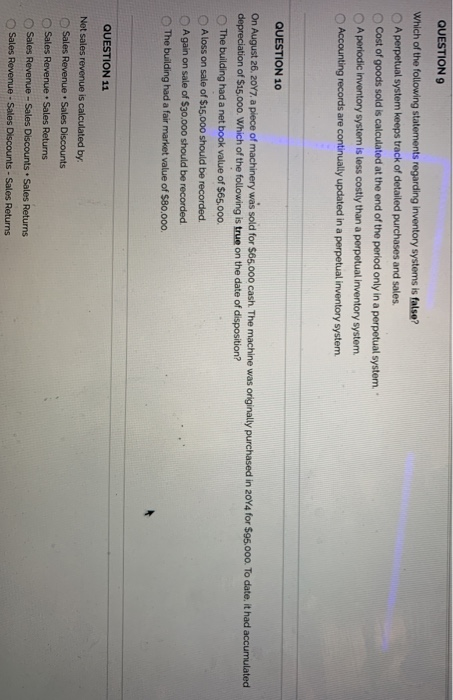

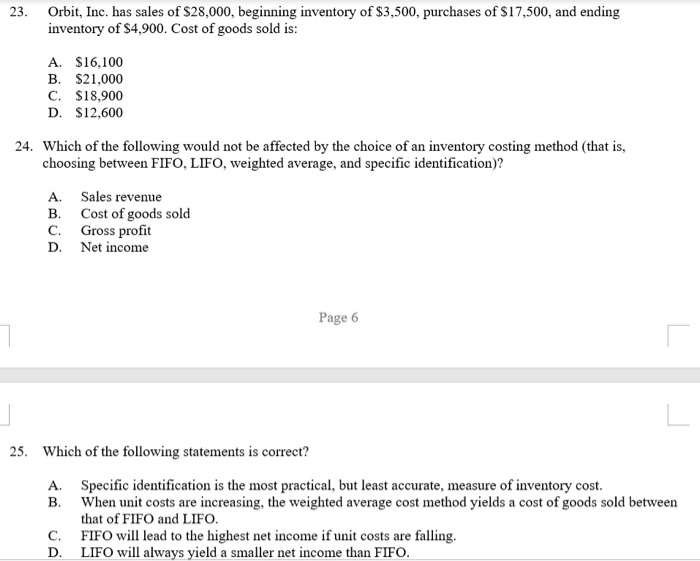

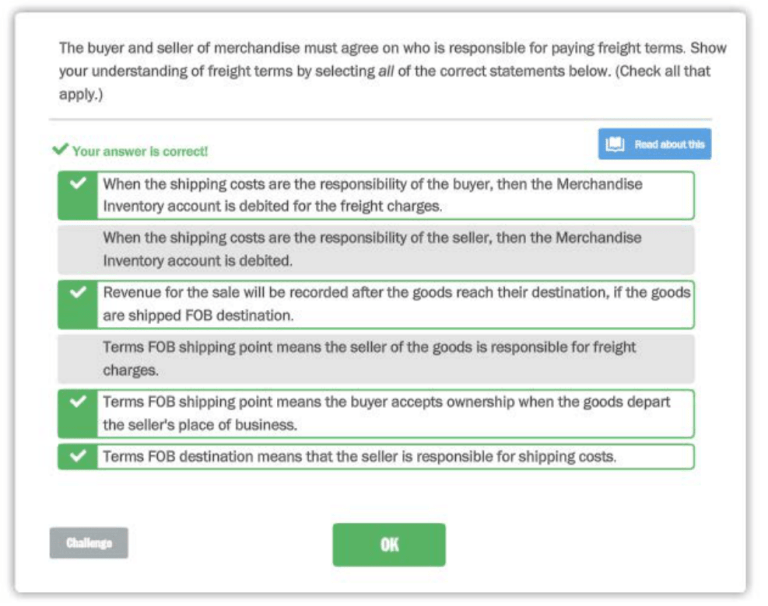

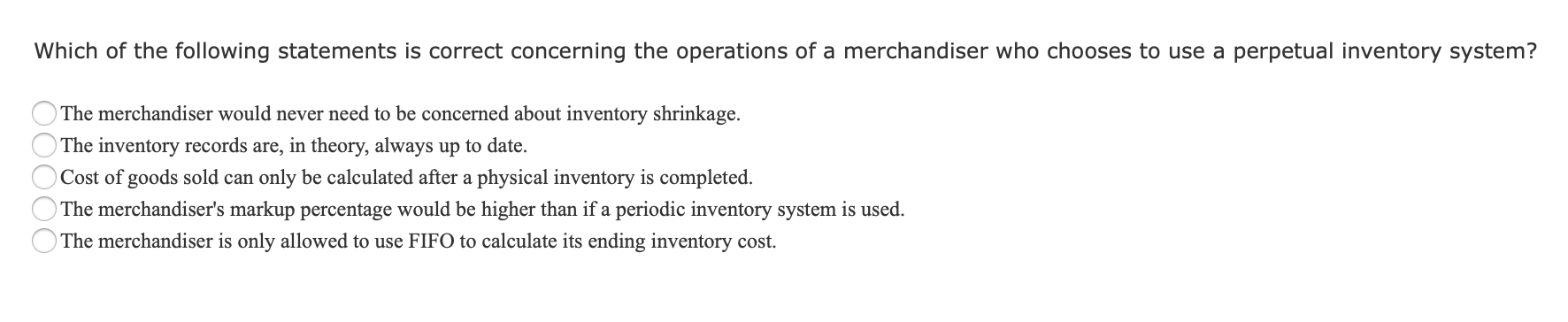

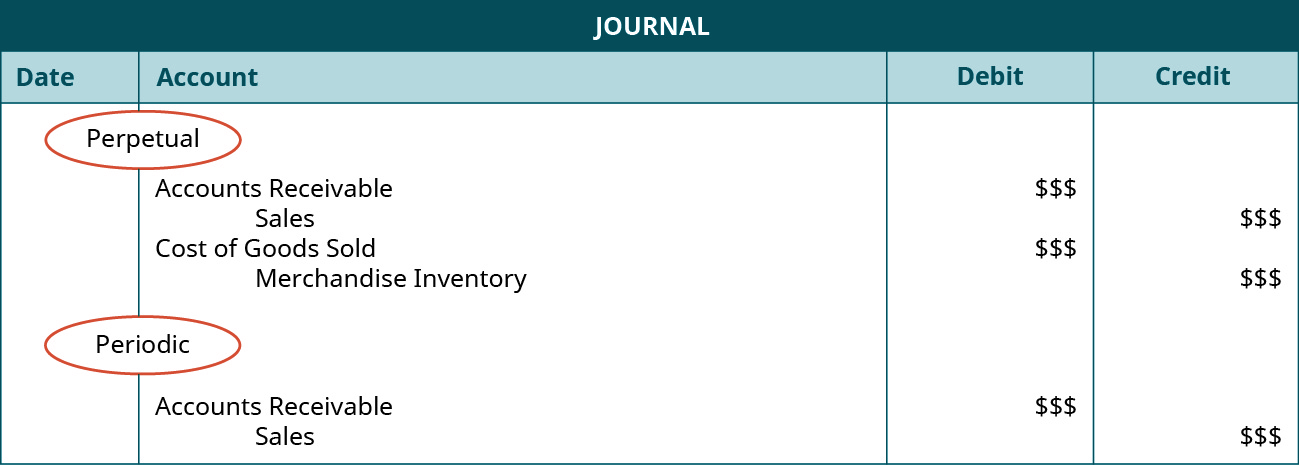

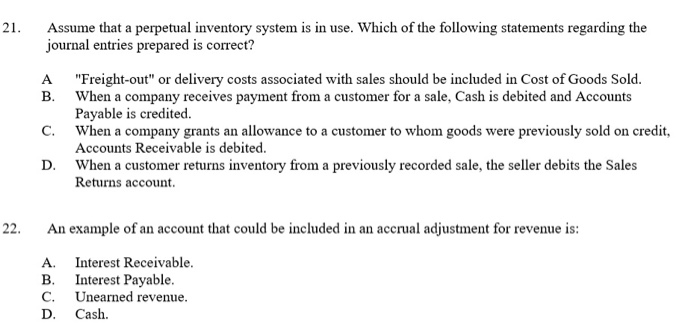

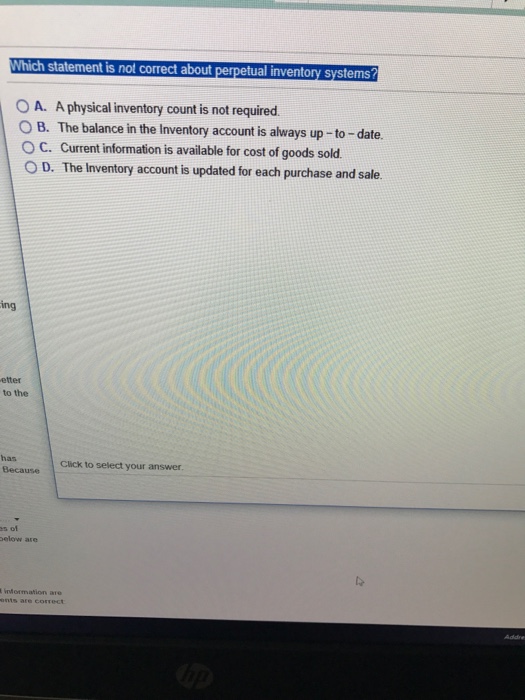

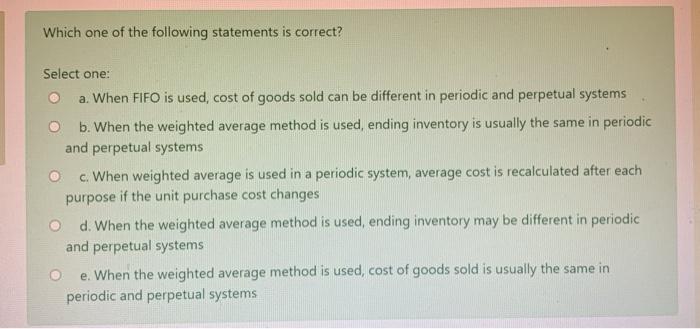

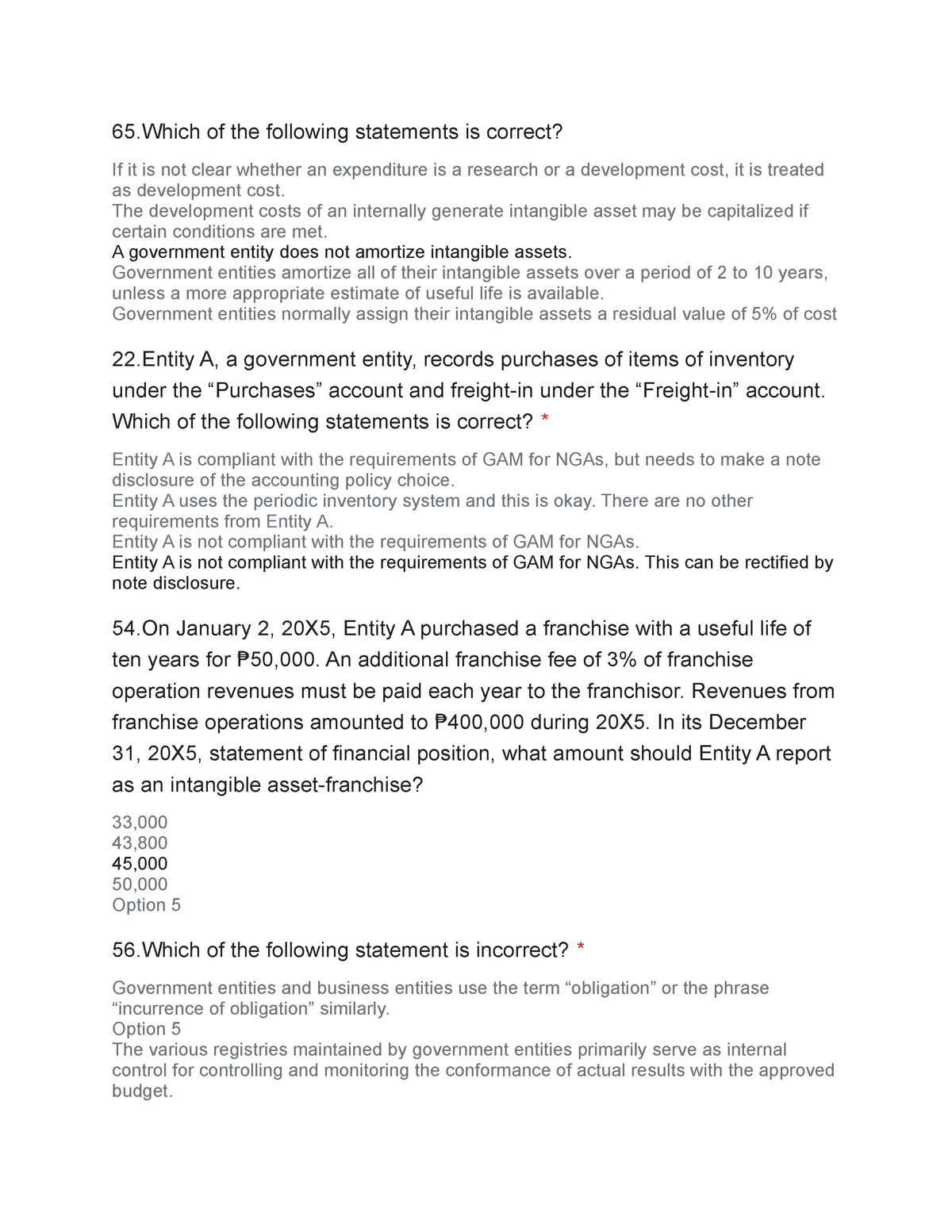

Any purchase discounts taken are debited. Which of the following statements is correct. Which of the following statements is correct with regard to the perpetual and periodic inventory systems.

Which of the following statements concerning audit evidence is correct. The cost of goods sold was overstated by 1000.

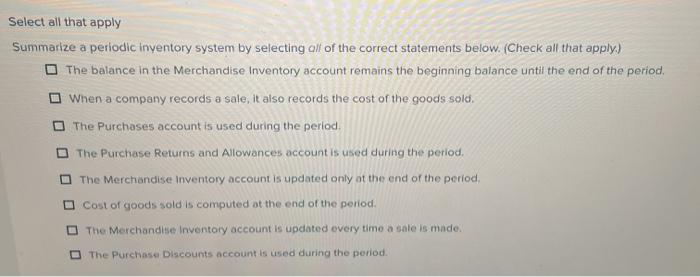

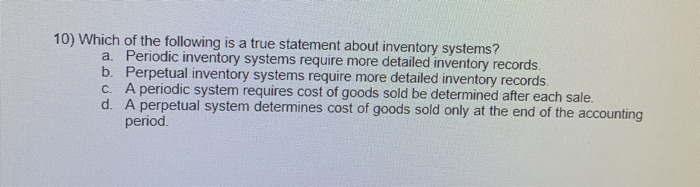

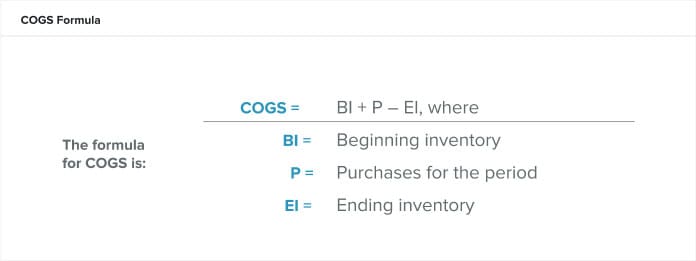

A Companies determine cost of goods sold only at the end of the accounting period.

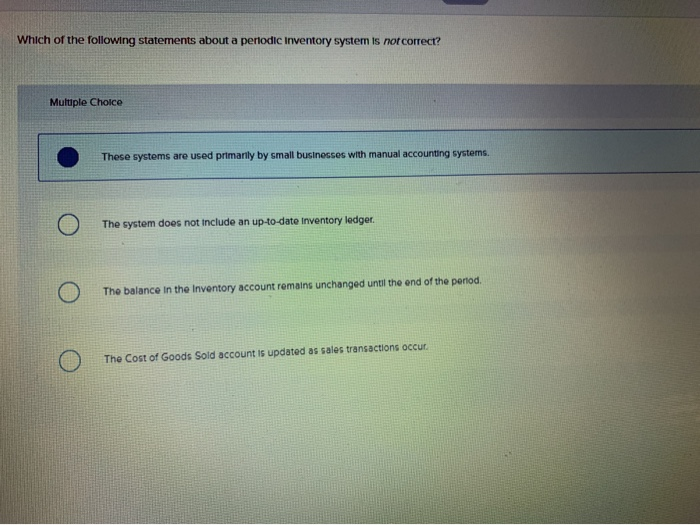

O A periodic inventory system computes cost of goods sold each time a sale occurs. Which of the following statements about inventory is true. These systems are used primarily by small businesses with manual accounting systems. Which of the following statements is correct with respect to inventories. Which of the following statements is correct regarding variable costing and absorption costing income statements for a company that has no beginning inventory and whose production exceeds sales for the current period. The cost of goods sold was overstated by 1000. B Inventory size increases as consumers purchase items. Use of a periodic inventory system allows the company to maintain up-to-date inventory records throughout the year. Hide Feedback Incorrect Check My Work Feedback Incorrect.

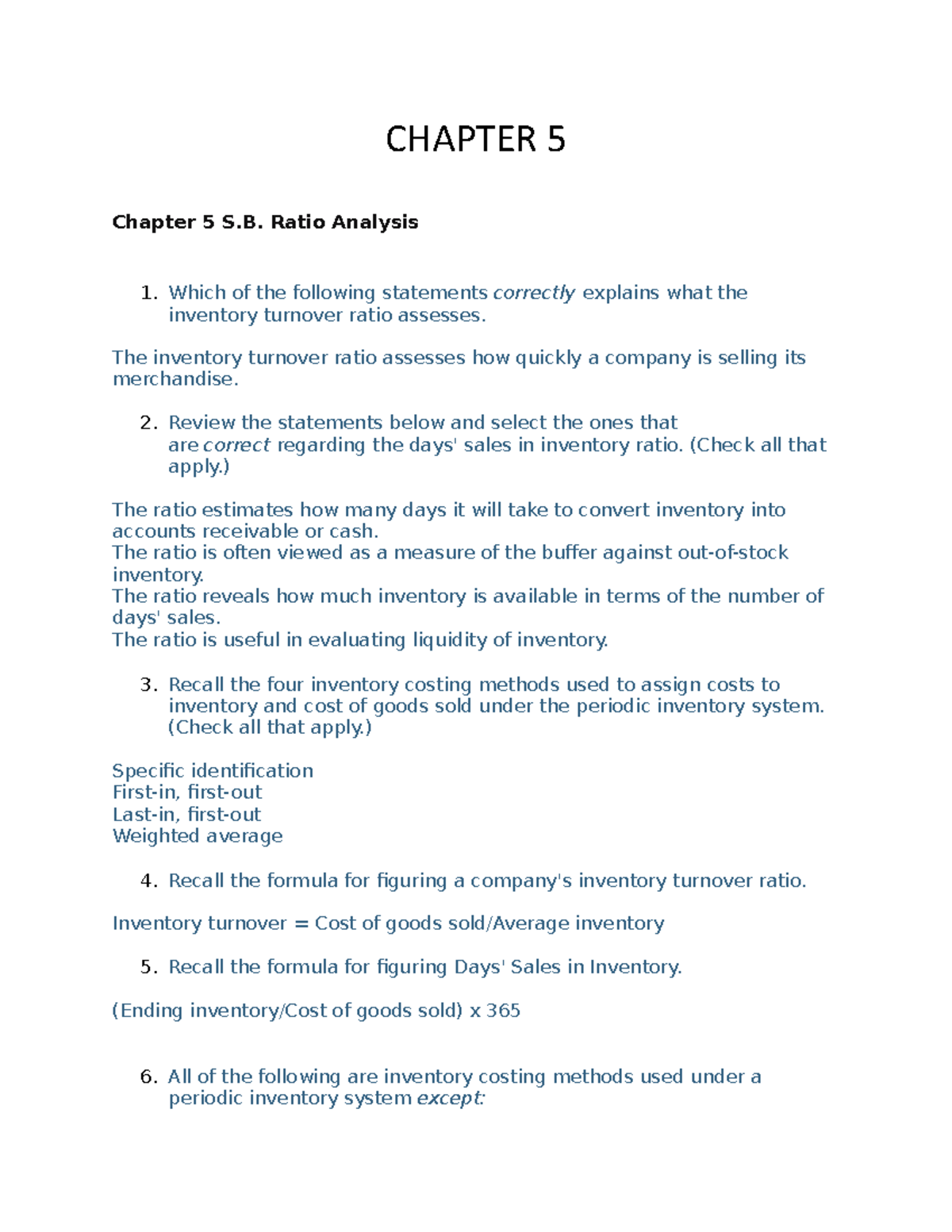

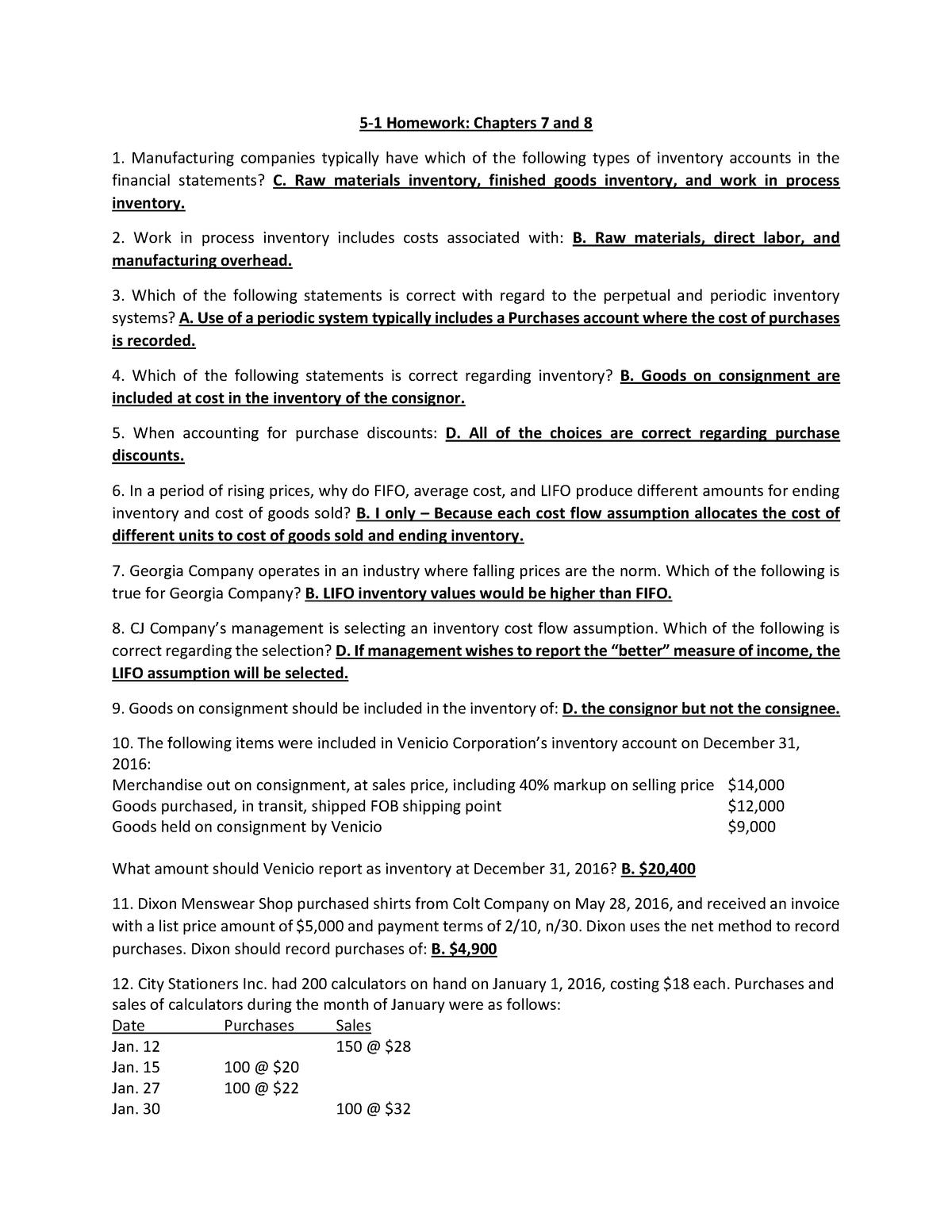

The FIFO method assumes that the costs of the earliest goods acquired are the last to be sold b. Use of the perpetual inventory system will. The purchase of inventory requires a debit to Inventory. The periodic inventory system is most useful for smaller businesses that maintain minimal amounts of inventory. And the details of the goods on hand which are not available in this system. Which of the following statements is correct according to a periodic inventory system. Use of a periodic system typically includes a Purchases account where the cost of purchases is recorded.

Post a Comment for "Which Of The Following Statements Is Correct About The Periodic Inventory System?"